Sitharaman has now brought down the.

Mat tax rate for ay 14 15.

18 50 000 higher of the two mat credit.

Thus the tax paid by the company would be rs.

So far the tax liability under mat provisions stood at 18 5 per cent of book profits net profit plus health education cess and surcharge as applicable.

Tax liability as per mat.

The mat rate currently stands at 21 55 percent against a top corporate tax rate of 34 94 percent.

In each finance bill the government increased the rate of mat and now this rate has increased to 18 5 in ay 2013 14 from 7 5 in ay 2001 02 and simultaneously kept reducing the difference between the mat and normal rate to reduce the eligibility of mat to the companies.

And one per cent.

For financial year 2014 2015 additional surcharge called the education cess on income tax and secondary and higher education cess on income tax shall continue to be levied at the rate of two per cent and one per cent respectively on the amount of tax computed inclusive of surcharge wherever applicable in all cases.

Mat is levied at the lower rate of 9 plus surcharge and cess as applicable for companies that are a unit of an international financial services centre and derive their income solely in convertible foreign exchange.

The taxation laws amendment bill 2019 proposed to insert a proviso to section 115jb 1 of the act that the rate shall be reduced from 18 5 to 15 from previous year commencing on or after april 1 2020.

It means as per the bill the reduced rate of 15 per cent for mat is applicable from ay 2021 22.

Hence the bill had proposed to defer the applicability of this provision by one year.

Respectively on the amount of tax computed inclusive of surcharge wherever applicable in all cases.

This credit would be carried forward to fy 2016 17 for xyz ltd.

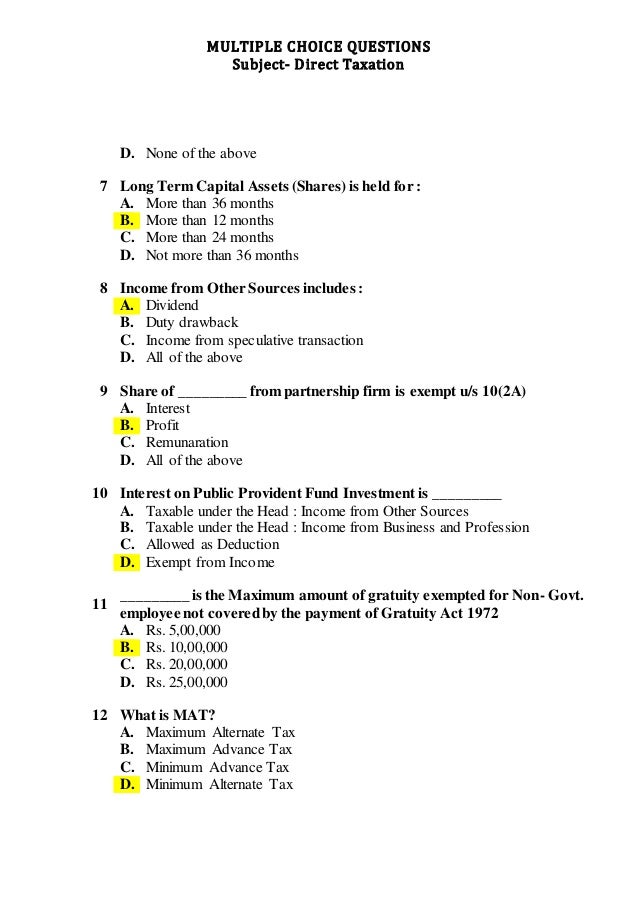

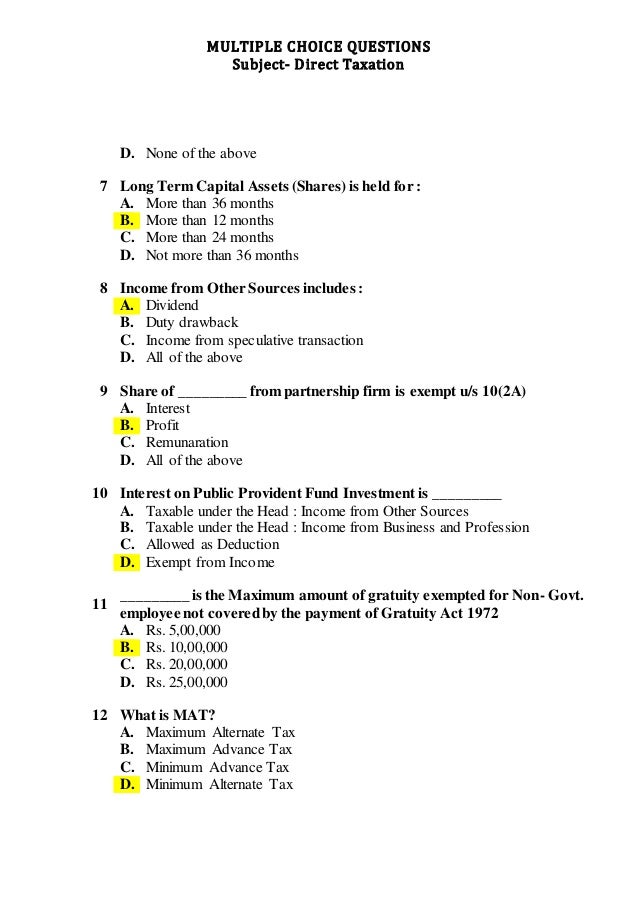

Minimum alternate tax mat.

For fy 2019 20 tax payable is computed at 15 previously 18 5 on book profit plus applicable cess and surcharge.

For financial year 2013 14 additional surcharge called the education cess on income tax and secondary and higher education cess on income tax shall continue to be levied at the rate of two per cent.

10 the minimum alternate tax mat on companies challenges and way forward.

The tax computed by applying 15 plus surcharge and cess as applicable on book profit is called mat.